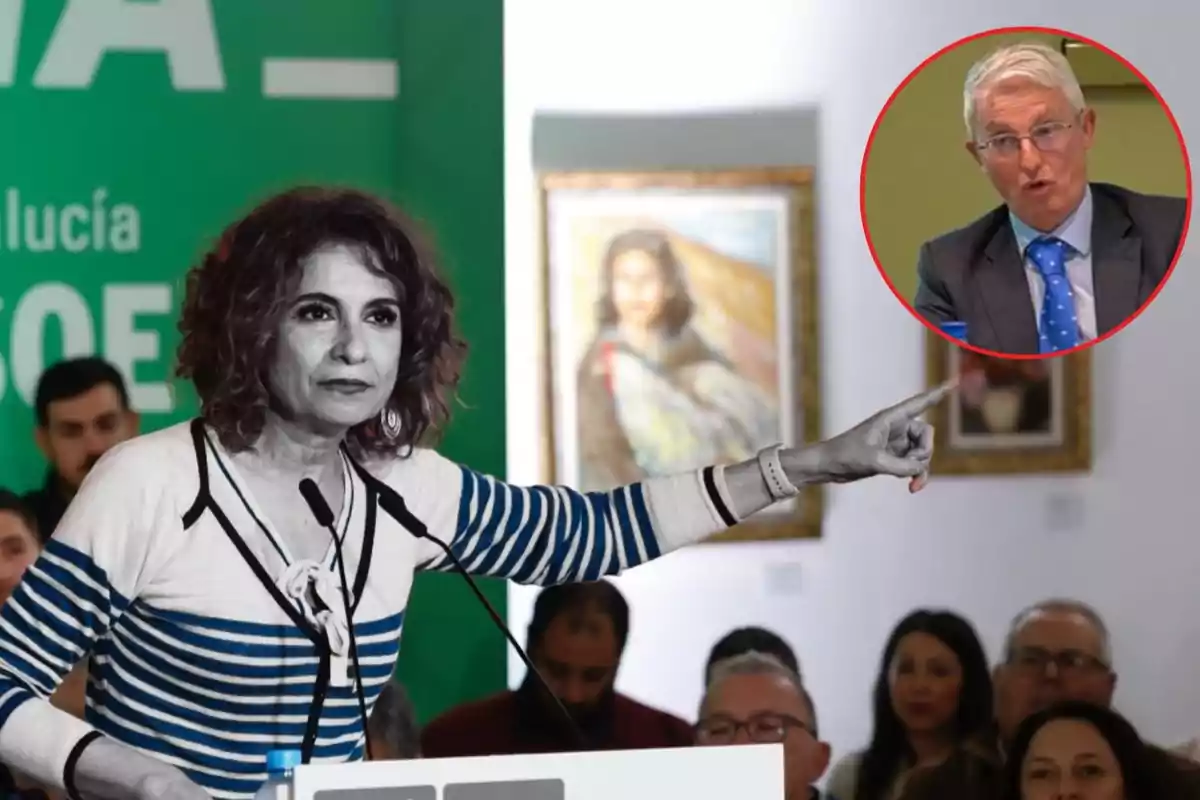

Who is Montero's Number-Three Man Who Uses His Company to Evade Taxes?

José Antonio Marco Sanjuán is considered a key figure within the Ministry of Finance and his closeness to Minister María Jesús Montero reinforces his position

Inspectors question José Antonio Marco Sanjuán's staying in office due to alleged tax irregularities. His situation creates disappointment within the sector and affects the credibility of the tax agency.

The president of the Central Economic Administrative Court maintains a holding company to pay fewer taxes. According to El Debate, his financial scheme draws criticism from his own colleagues within the Administration.

José Antonio Marco Sanjuán has managed the company Investment Betancunia SL since 2003. With it, he has acquired properties, billed for classes and lectures, and conducted other economic operations.

Tax inspectors report that his income should have been taxed under the IRPF (the tax on income), but he diverted it to a company to reduce his tax burden. This allowed him to benefit from a lower fixed rate than the marginal IRPF rate.

In its annual accounts, Investment Betancunia SL has declared negative taxable bases. These figures have allowed compensations that significantly reduce effective taxation.

Marco Sanjuán concealed his participation in a real estate network with convictions for non-payments in his high-ranking asset declaration. He quickly sold assets to partners when tax problems arose.

The high-ranking official also didn't declare the acquisition of land in Tarragona with a businessman benefiting from public aid. These omissions have led to a recent complaint for document falsification.

In addition to billing lectures through his company, he used Investment Betancunia SL to manage rental income. This avoided taxing under the IRPF as real estate capital income.

While engaging in these practices, Marco Sanjuán participated in talks on fighting tax fraud. His role in these conferences contrasts with his own tax avoidance strategies.

The situation has caused deep unrest among tax inspectors. They believe his continuation in office undermines the system's credibility and the public image of the tax agency.

Various experts point out that this type of tax scheme undermines the principles of transparency and tax equity. Marco Sanjuán's continuation in his position raises doubts about the neutrality of the tax agency.

José Antonio Marco Sanjuán is considered a key figure within the Ministry of Finance. His closeness to Minister María Jesús Montero strengthens his position despite the complaints.

The scandal surrounding his figure calls into question the Government's fiscal policy. Montero's management faces criticism for allowing these practices within her trusted circle.

As pressures for his resignation grow, the Tax Administration faces a reputation crisis. The public views the agency's management with skepticism.

Marco Sanjuán: the key figure within the Ministry of Finance

José Antonio Marco Sanjuán holds a degree in Economics and Business from the University of Zaragoza. Additionally, he graduated in Law from UNED.

He is a State Tax Inspector and belongs to the fourth class of the State Finance Inspectors Corps. He is specialized in Inspection and Customs and Special Taxes.

Since 2005, José Antonio Marco has been President of the Regional Economic-Administrative Court of Castilla y León. The Burgos Decentralized Chamber was under his responsibility.

He was also Special Delegate of the State Tax Administration Agency in Cantabria from 2001 to 2005. Additionally, he was Provincial Delegate in Palencia and Zamora between 1998 and 2001.

Previously, he was Chief Inspector in Valladolid and served as Inspector in the State Tax Administration Agency in Tarrasa. He was also Unit Chief in Tarragona.

More posts: