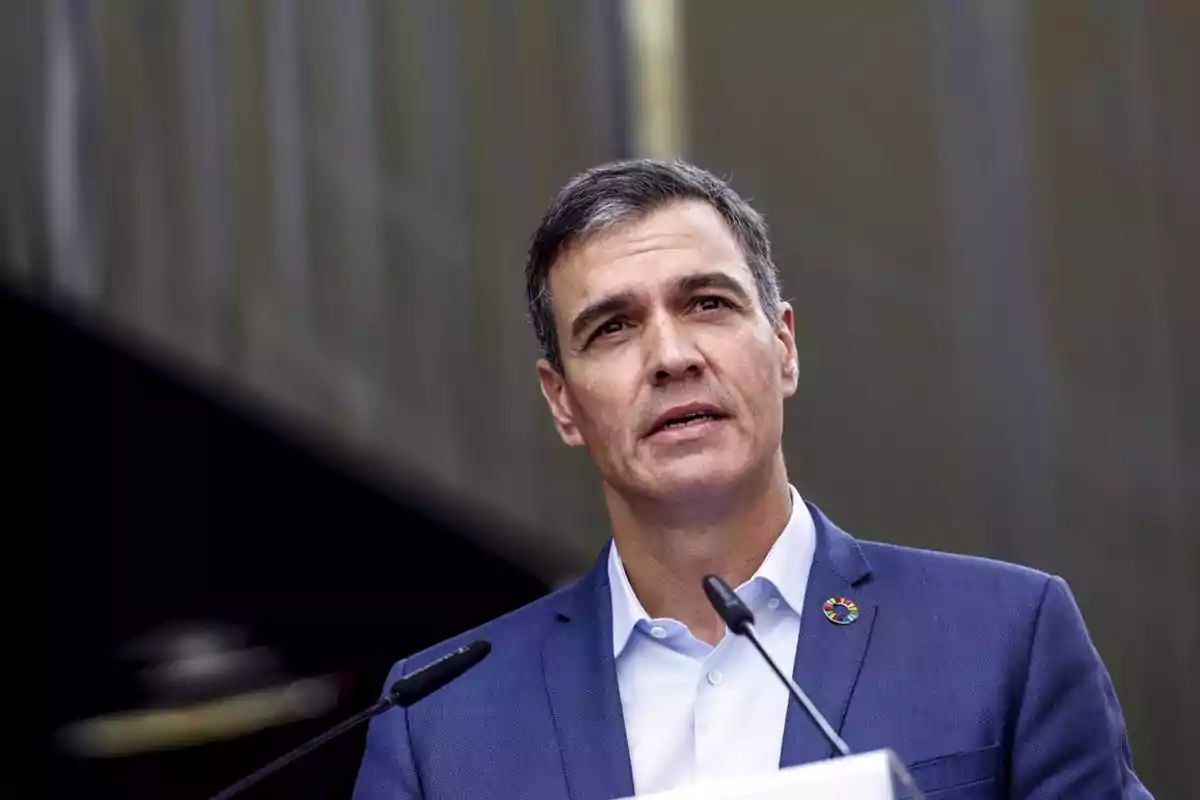

Sánchez's Veto of Poland Leaves Talgo in PNV's Hands

The Government rejects the Polish offer and favors Sidenor in an operation with clear political overtones

The Government of Sánchez Has Vetoed the Purchase of Talgo by the Polish State Fund PFR, despite its offer being more advantageous.

The Polish company, owner of the train manufacturer Pesa, offered 5 euros per share to acquire 100% of the company.

In contrast, Sidenor's Proposal, Supported by the PNV, only contemplated the purchase of 29.76% at a fixed 4.15 euros per share. Additionally, 0.65 euros more if certain objectives were met in 2027 and 2028.

PFR's Plan not only offered greater financial backing but also involved integration with Pesa. Both companies have complementary specializations: Pesa focuses on subways and trams, while Talgo is a leader in high-speed trains.

Moreover, the Polish government already has an agreement with Talgo for the development of this technology in their country. The union with Pesa would have boosted Talgo's expansion in Eastern Europe, with more investment and production capacity.

Despite these benefits, the Polish offer was rejected in recent days after a visit by Minister Carlos Cuerpo to Poland.

According to knowledgeable sources, the main reason for the veto was the Polish government's participation in the investment fund. This would contrast with the Spanish Executive's intention to favor Sidenor. The company includes maintaining 700 jobs at the Rivabellosa (Álava) plant and relocating Talgo's headquarters from Madrid to the Basque Country.

Pressure to Favor Sidenor and SEPI

The Spanish Government would have urged Sidenor to improve its offer to 5 euros per share, adjusting the variable incentives.

However, this operation only covers part of the company. Currently, the Ministry of Transport, led by Óscar Puente, would be pressuring SEPI to acquire the remaining percentage of the company.

This maneuver would allow the Government to increase its control over Talgo and place allies on the board of directors.

One of the factors that could influence the negotiation is the 116 million euro fine imposed on Talgo for problems with the Avril trains.

Renfe, a public company, could use this fine as a tool to influence the future of the railway company.

Industry sources believe that this situation paves the way for SEPI's entry into Talgo. Something that would strengthen governmental control over the company.

The sale to Sidenor doesn't solve Talgo's problem, which is the need for an investor to acquire 100% of the company.

The current majority shareholder, the Trilantic fund, has been looking to sell its stake since 2019 and attempted to do so in 2022 without success.

Pesa and the Indian Jupiter Wagons, with sufficient capital, could have been viable options, but government policy has halted any possibility of international sale.

Meanwhile, Talgo's image is being damaged by the uncertainty about its future. Despite the situation, the company maintains positive results.

In the first nine months of 2024, its revenues grew by 5.8%, reaching 497.8 million euros. Its operating result increased by 71.7%, reaching 57.7 million, and its order book totals 3.987 billion euros, indicating good business prospects.

If the Government wants to justify its intervention in Talgo, it could argue that it is a strategic company. However, some experts question this claim.

According to analyst César Sánchez-Grande, Talgo's strategic nature is "zero." He also adds that its variable gauge technology is also licensed to CAF by Adif.

This stance reinforces the idea that the governmental decision responds more to political interests than business criteria.

More posts: