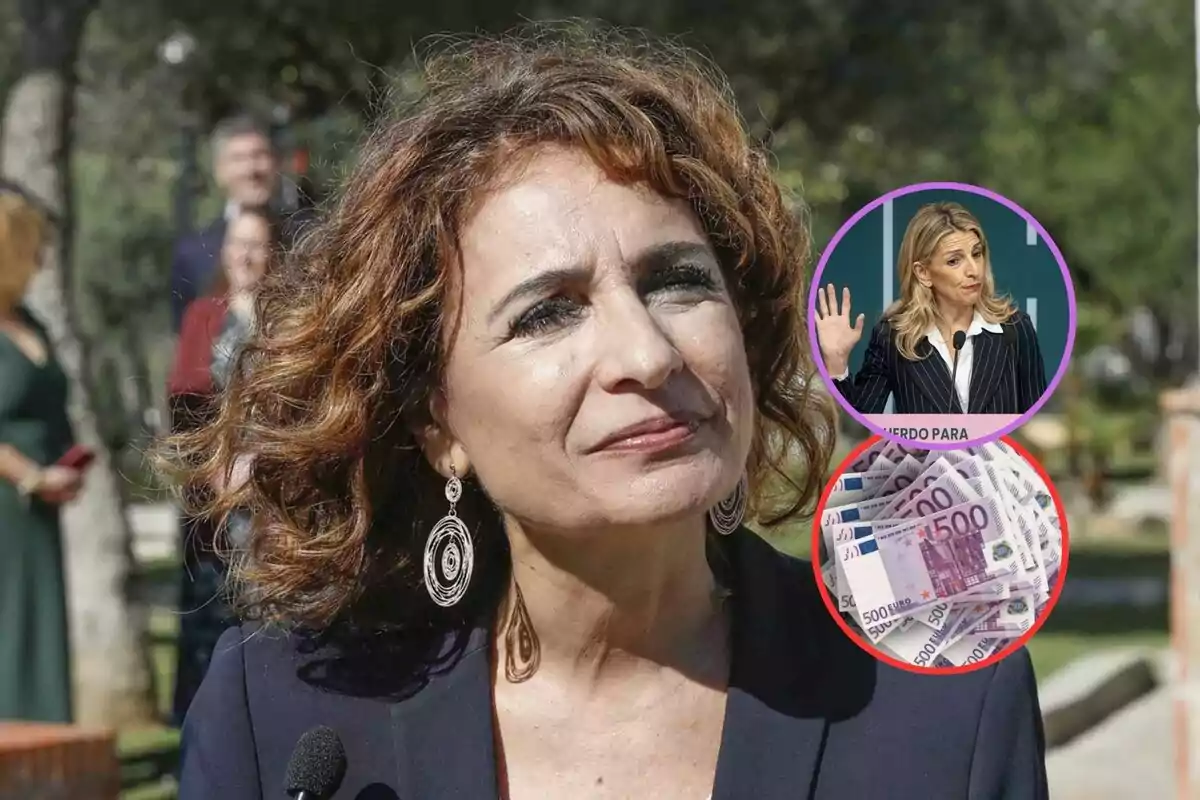

The Government's Trick With the Minimum Wage: Only 25 Euros More for Employees

Hacienda decides that the SMI will pay IRPF and will make the net increase that reaches the worker

According to estimates released by the People's Party, a worker earning the minimum wage will see an increase of 700 euros per month in their salary. However, out of this amount, 346 euros will be withheld by the State through Social Security contributions and income tax.

The consequence for the worker will be that the 50 euros more per month that Yolanda Díaz agreed with the unions is not real. The reality is that it will be reduced to half, about 25 euros.

This translates to only leaving 354 euros as real gain for the employee.

This calculation represents the highest scenario, as the tax impact will vary depending on each worker's personal situation. Factors such as marital status, the number of dependent children, among others, will be considered.

The problem lies in the fact that, by not adjusting the income tax threshold according to the Minimum Wage, it will exceed the taxation limit by 2025. Therefore, it will force employees to allocate up to 43% of the planned increase to tax payments.

The measure adopted by the Ministry of Finance responds to the growing revenue derived from the continuous increase of the minimum wage. Since 2018, this wage has increased by approximately 60%, which has caused more and more taxpayers to be affected.

All this in a crucial context for the stability of public finances due to the reactivation of fiscal regulations.

Meanwhile, Yolanda Díaz has expressed her disagreement with this decision, especially due to its impact on workers with lower incomes. Meanwhile, she promotes a reduction in income tax for homeowners who choose to lower rental prices.

In other words, although the Ministry of Labor has expressed its opposition, it acknowledges that the final decision lies with María Jesús Montero.

This Is How the Treasury Will Penalize Transfers Between Parents and Children

Money transfers between parents and children have been a common practice in many Spanish families. However, the Tax Agency has focused on these operations to prevent them from being used as a mechanism to evade tax payments.

Starting in 2025, any financial movement between family members that exceeds certain thresholds will be subject to greater scrutiny, with penalties for those attempting to conceal undeclared donations.

The main objective of the Treasury is to prevent hidden donations from being made without paying the corresponding Inheritance and Gift Tax.

To this end, banks are required to automatically report any transfer exceeding 3,000 euros. This will allow the Tax Agency to identify possible irregularities and, if deemed necessary, initiate investigations into the origin and destination of the money.

If the transferred amount reaches 6,000 euros, the Treasury may request additional documentation to verify that the movement of funds complies with regulations.

In cases where an undeclared donation is detected, financial penalties will be imposed, which may include surcharges and late payment interest.

More posts: