Nebeus reveals the economic issues that are of most interest in Spain for 2025.

From how to invest in the stock market to safe strategies for diversifying capital

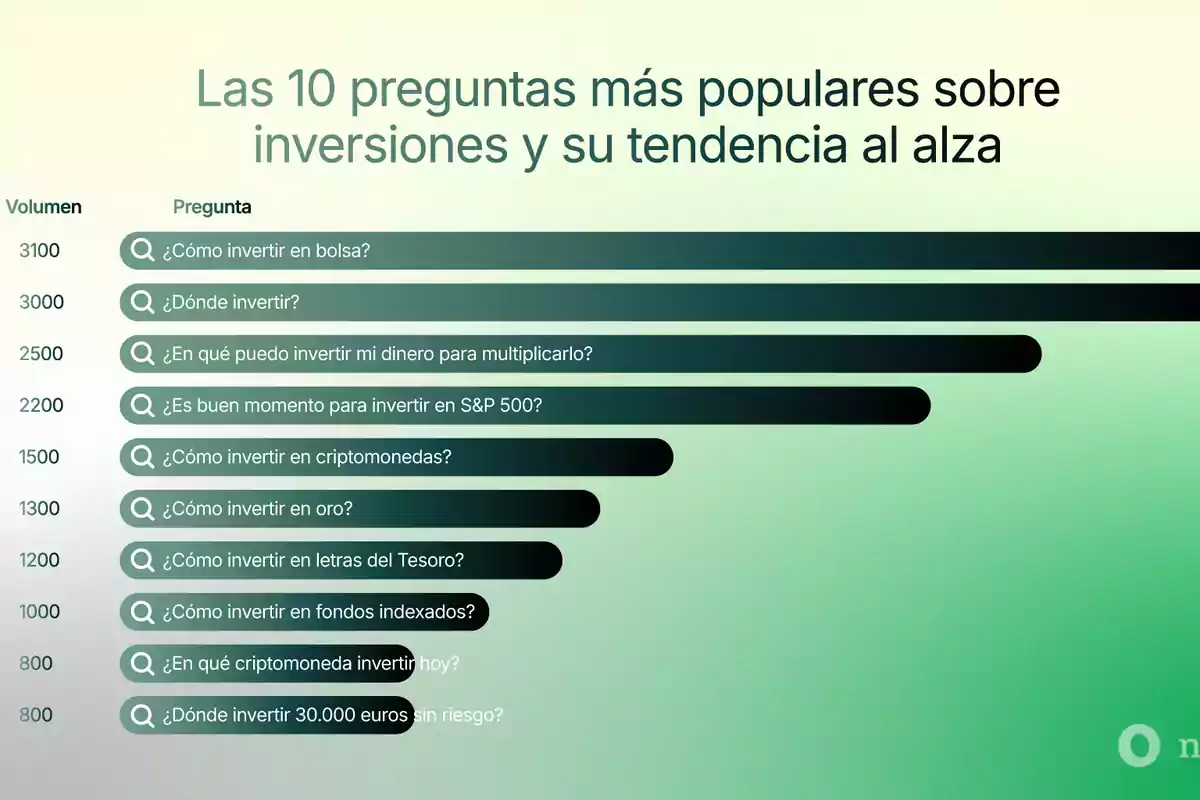

The interest in financial education is marking a before and after in Spain's economic trends. According to an analysis conducted by Nebeus, a global payments platform, the volume of searches related to investments has shown consistent growth since 2023, with a strong surge in 2024 and an upward trend for 2025. This behavior reflects a clear priority among Spaniards to learn how to manage their money in an environment of high inflation and economic volatility. The rise of investments: stock market, cryptocurrencies, and Treasury Bills Questions related to investments have been the most prominent in Spaniards' searches. Among the recurring topics are how to invest in the stock market, where to invest, and which financial alternatives can multiply their money. More traditional options, such as index funds, gold, and Treasury Bills, are gaining popularity, attracting those seeking stability and diversification. "Beyond the emergency fund, it's vital for households to diversify their financial strategies. Products like fixed-term deposits or low-cost index funds are essential tools to protect against inflation," says Lena Kuzmenko, a financial specialist at Nebeus. Kuzmenko also highlights the role of technologies: "Financial apps that automate savings, generate passive income, and prioritize clear goals, like long-term investment, are helping families maintain financial discipline." Meanwhile, interest in cryptocurrencies has resurged, highlighting how digital assets are once again positioning themselves as key tools in investment portfolios. According to Nebeus, this renewed interest is driven by a more mature market, clear regulations, and greater accessibility to digital financial tools. "The use of loans to diversify investments has been one of the most notable use cases we've observed. Users seek to avoid selling their main assets and prefer to employ capital in opportunities like purchasing more cryptocurrencies or investments in traditional markets like the stock market. We've also identified a growing interest in using this liquidity to finance businesses, as they allow for quick funding and balance optimization," states Lucía Colli, Marketing Specialist at Nebeus. Searches related to fixed-rate mortgages increase by 49% Another key area revealed by the analysis is the interest in financial products such as mortgages, personal loans, and credit cards. Searches related to mortgages have increased by 49% in the past year, with a preference for fixed-rate ones. Additionally, credit cards have seen a 40% increase, highlighting digital and accessible options and cards without annual fees. There has also been a greater use of tools like simulators and financial calculators. "At Nebeus, we've observed a growing interest in this topic from our users, especially for complex products. These tools make it easier to understand the risks and benefits before taking action, but education remains the key to bridging the gap between the interest in investing and actual action," concludes Colli.

More posts: